All Categories

Featured

Table of Contents

- – Senior Insurance Placentia, CA

- – Harmony SoCal Insurance Services

- – Medicare Advantage Plans Near Me Placentia, CA

- – Health Insurance For Seniors Without Medicare ...

- – Health Insurance For Seniors Over 60 Placenti...

- – Delta Dental Insurance For Seniors Placentia, CA

- – Dental Insurance For Seniors With No Waiting...

- – Health Insurance For Seniors Placentia, CA

- – Senior Dental Insurance Placentia, CA

- – Harmony SoCal Insurance Services

Senior Insurance Placentia, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

For vision solutions, typical out-of-pocket spending was $194 among beneficiaries in Medicare Advantage and $242 amongst recipients in standard Medicare. Many Medicare Advantage enrollees had coverage for some dental, vision and hearing advantages, as explained below, but still incurred out-of-pocket prices for these solutions. Lower typical out-of-pocket spending amongst Medicare Advantage enrollees for oral and vision treatment is most likely due to a number of factors.

Among the 20.2 million beneficiaries who reported trouble seeing, 11% (2.1 million recipients) stated there was a time in the last year they can not obtain vision care, and amongst the 25.9 million beneficiaries who reported difficulty hearing, 7% (1.8 million recipients) stated there was a time in the in 2015 they could not get hearing care.

This includes 75% of those who couldn't obtain hearing care, 71% of those who couldn't obtain oral treatment, and 66% of those that couldn't get vision treatment. Placentia Vision And Dental Insurance For Seniors. Amongst beneficiaries in standard Medicare and Medicare Benefit that reported gain access to troubles in the in 2014 for dental, hearing, or vision treatment, roughly 7 in 10 beneficiaries in both groups stated that price was an obstacle to obtaining these services (72% and 70%, specifically)

Amongst these enrollees, practically all (95%) are in plans that provide access to both hearing examinations and hearing help (either outer ear, inner ear, or over the ear).

Medicare Advantage Plans Near Me Placentia, CA

Of the 69% of enrollees with accessibility to fitting and evaluation for listening device, regarding 88% are in strategies that have frequency limits on those solutions, with one of the most usual limitation disappearing than when per year. Most enrollees (91%) remain in plans with regularity limitations on the variety of hearing help they can receive in a provided period.

Nearly 3 quarters of all enrollees (74%) are in plans that do not need price sharing for hearing exams, while 11% of enrollees are in plans that report cost sharing for hearing examinations, with the bulk being copays, which range from $15 to $50. Data on cost sharing is missing out on for strategies that cover the continuing to be 15% of enrollees (see Techniques for additional information).

Over half of enrollees (58%) in plans that cover spectacles are limited in exactly how often they can obtain a new pair. Among those with a limitation on glasses, the most common restriction is one set annually (52%), followed by one set every two years (47%). Among strategies that cover contact lenses, one third of enrollees (33%) are in plans that have frequency restrictions on contact lenses, normally once each year.

Many enrollees (71%) pay no charge sharing for eye tests, while around 14% of enrollees remain in plans that report price sharing for eye exams, with essentially all needing copays, ranging from $5 to $20. Information on cost sharing is missing for strategies that cover the remaining 15% of enrollees.

Health Insurance For Seniors Without Medicare Placentia, CA

About 2% of enrollees are in plans that need price sharing for either spectacles or calls, with virtually all requiring copays; these enrollees are also subject to a yearly buck cap. In performing this analysis of Medicare Benefit advantages, we located that plans do not utilize typical language when defining their advantages and include differing levels of information, making it testing for customers or researchers to contrast the extent of covered advantages across strategies.

glasses, graduated lenses), the degree to which prior permission rules are enforced, or network restrictions on providers. While some Medicare recipients have insurance coverage that aids cover some oral, hearing, and vision expenses (such as Medicare Advantage plans), the scope of that protection is typically limited, leading several on Medicare to pay out-of-pocket or forego the assistance they need due to prices.

Health Insurance For Seniors Over 60 Placentia, CA

We assessed out-of-pocket costs on dental, hearing, and vision solutions (individually) among community-dwelling recipients on the whole, and among the part of community-dwelling recipients that were coded as having a dental, vision, or hearing event. This analysis was weighted to stand for the ever-enrolled populace, making use of the Cost Supplement weight 'CSEVRWGT'. We also examined out-of-pocket investing amongst community-dwelling beneficiaries who reported having difficulty hearing or difficulty seeing.

This analysis includes enrollees in the 50 states, Washington D.C., and Puerto Rico. Strategies with enrollment of 10 or fewer individuals were additionally omitted due to the fact that we are unable to obtain accurate enrollment numbers. For cost-sharing quantities for dental, vision, and hearing coverage, lots of strategies do not report these figures, and in situations where enrollee expense sharing does not include up to 100%, it results from strategies not reporting this information.

Some Medicare Benefit Plans (Part C) use additional advantages that Original Medicare doesn't cover - like vision, hearing, or oral. Call the prepare for more details.

Medicare supplement strategies don't cover preventative oral, hearing or vision advantages. But if you have one of our Blue Cross Medicare SupplementSM strategies, you can include our Oral Vision Hearing Plan for $34.50 each month. The costs cost might be re-evaluated annually and is subject to change. This additional insurance coverage offers: $0 in-network dental examinations, cleansings, X-rays and fluoride therapy In-network vision insurance coverage that consists of standard lenses every twelve month One $0 hearing exam every twelve month and cost savings of up to 60% off typical retail listening device rates at a TruHearing service provider Find out when you can enlist based upon whether you're a new or present Medicare supplement participant.

Delta Dental Insurance For Seniors Placentia, CA

You can include this protection when you're enrolling in a Blue Cross Medicare Supplement plan. If you've already authorized up for a plan yet didn't get the package, you can include it on within the first 30 days of your reliable date.

For instance, some Medicare Advantage plans include listening to treatment benefits that can be found in the kind of a discount program. These discount programs can be restricting, specifically when you're attempting to balance out the costs of listening devices, which can vary anywhere from $ 1,000-$ 6,000 per device

Read on to learn more concerning DVH strategies and how they could fit your protection needs. Interested in discovering a Dental Vision Hearing strategy?

Benefits vary by plan and place. OK, so you're thinking you might desire to discover a DVH strategy.

Dental Insurance For Seniors With No Waiting Period Placentia, CA

" If they have a trouble with their eye, that's under medical." Hearing examinations Hearing help( s) Whether a policy will certainly meet your needs depends upon what it specifically covers and what it does not. Always review the small print or seek advice from the strategy's brochure to see what is covered and what is excluded.

If you do not have group protection, an individual DVH plan might be a convenient method to buy oral, vision and hearing protection. If you're especially buying listening to coverage, DVH plans might be a default option. "There's not a stand-alone hearing plan there," Riggs states. "You can not just go acquire a hearing strategy." If you don't require hearing protection, contrast the expenses and benefits of a packed DVH strategy to purchasing separate oral and vision plans.

Health Insurance For Seniors Placentia, CA

" It's truly the listening to a great deal of times that will establish whether you buy DVH." DVH plans additionally may cover dental services that typical oral plans have a tendency not to cover. "You will find DVH strategies that have a whole lot extra coverages in the bridges and the denture group, because they are designed for elders," claims Riggs.

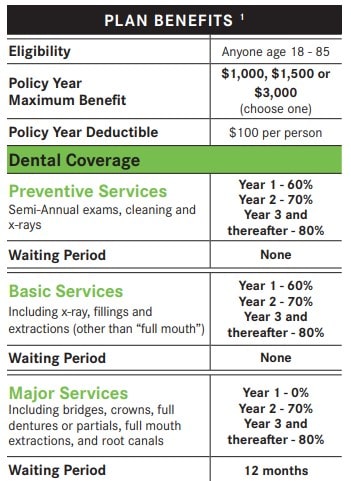

Just specific adult plans include vision insurance policy and as Riggs pointed out, stand-alone hearing plans might be difficult to discover. A DVH plan can supplement your option. When you're comparing DVH strategies, you have to do the math, particularly to approximate what your out-of-pocket expenses will certainly be. Comparable to wellness insurance coverage plans, DVH plans consist of restrictions such as: Yearly and lifetime maximum usage caps Waiting periods Copayments Limited or no coverage if you head out of network "One of the biggest aspects of dental is the optimum use every year," Riggs claims.

" Sometimes people need a whole lot a lot more oral protection than that," she adds. "So, I'll look for plans that have maybe $3,000 or $5,000. It's mosting likely to really come down to that person's demand." You also may need to await insurance coverage to start, specifically for oral. "There's normally a 6-month waiting period for minor restorative and a 12-month waiting period for major restorative, like root canals and crowns," Riggs states.

Look at taken care of prices, such as premiums, and potential out-of-pocket prices, such as copays. Read the great print on restrictions, such as annual caps, which are the optimum advantage enabled for an assigned timeframe.

Senior Dental Insurance Placentia, CA

If you have hearing demands, contribute to this total the cash money expense of hearing examinations and hearing help. To lower the price of hearing help, think about over the counter models and listening devices marketed by club discount merchants. In some states, also if you do not make use of the hearing advantages, a DVH plan might be extra cost-efficient than purchasing different dental and vision strategies.

Need more details on Oral Vision Hearing plans? Call a qualified insurance policy representative at to speak about plans, or browse your choices online today. This policy has exemptions, limitations, decrease of benefits, and terms under which the plan may be continued active or stopped. For costs and total information of the insurance coverage, phone call or compose your insurance coverage representative or the business.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

( Part C) intends cover regular dental services. These strategies must cover all the very same services used under initial Medicare, however they may also give added benefitssuch as preventative oral care, which can include dental exams, cleansings, and X-rays. If you have this kind of strategy, check to see what dental protection it includes.

Placentia, CAPlacentia, CA

Placentia, CA

Finding A Good Seo Solutions Placentia, CA

Finding A Good Local Seo Agency Placentia, CA

Harmony SoCal Insurance Services

Table of Contents

- – Senior Insurance Placentia, CA

- – Harmony SoCal Insurance Services

- – Medicare Advantage Plans Near Me Placentia, CA

- – Health Insurance For Seniors Without Medicare ...

- – Health Insurance For Seniors Over 60 Placenti...

- – Delta Dental Insurance For Seniors Placentia, CA

- – Dental Insurance For Seniors With No Waiting...

- – Health Insurance For Seniors Placentia, CA

- – Senior Dental Insurance Placentia, CA

- – Harmony SoCal Insurance Services

Latest Posts

Tankless Water Heater Service Del Mar

Water Heater Maintenance Bernardo Village

Carmel Valley Tankless Water Heater Repairs

More

Latest Posts

Tankless Water Heater Service Del Mar

Water Heater Maintenance Bernardo Village

Carmel Valley Tankless Water Heater Repairs